Free Living Trust Forms Oregon

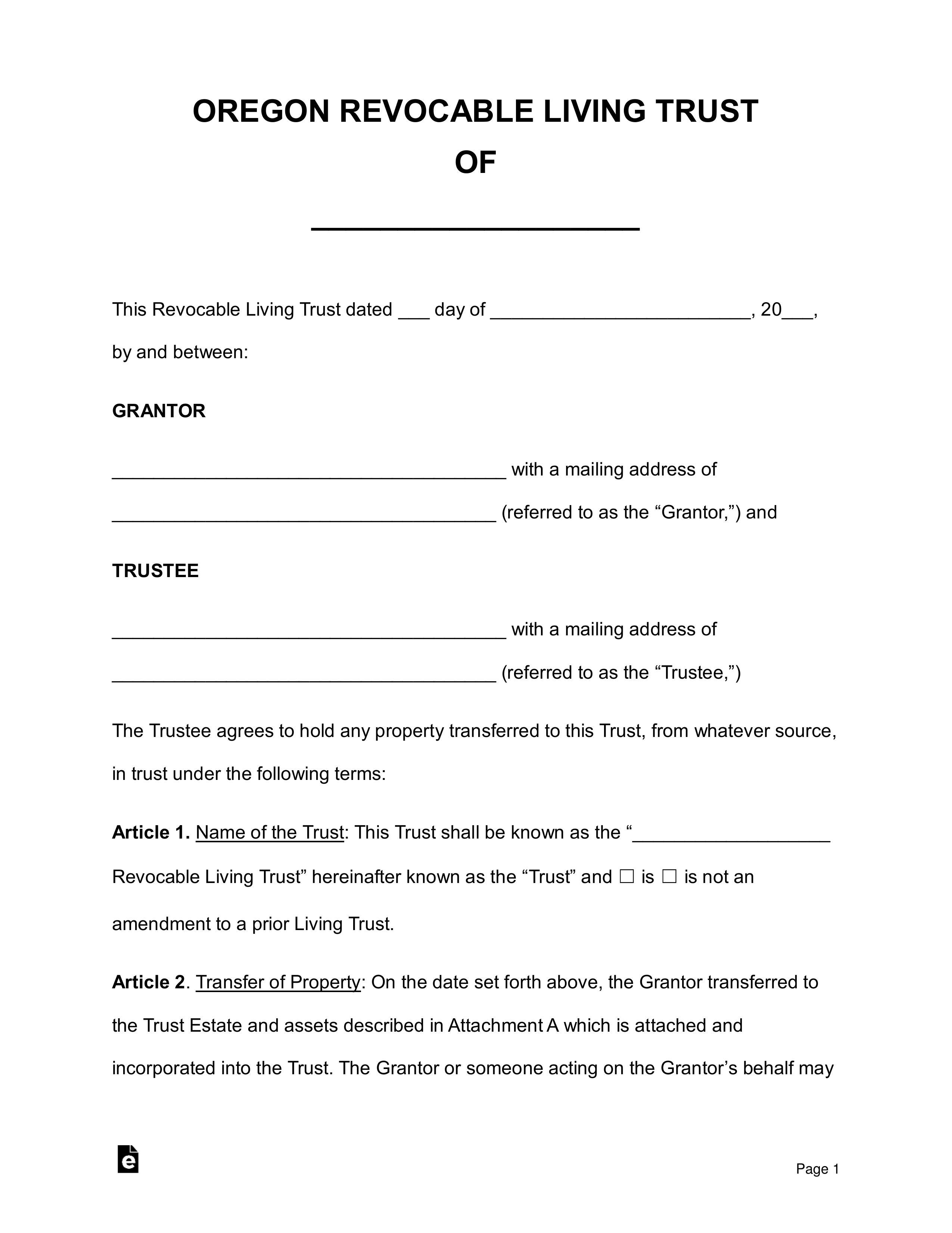

Download an oregon living trust form which allows you to place certain of your assets and property into a separate entity which is managed by a trustee.

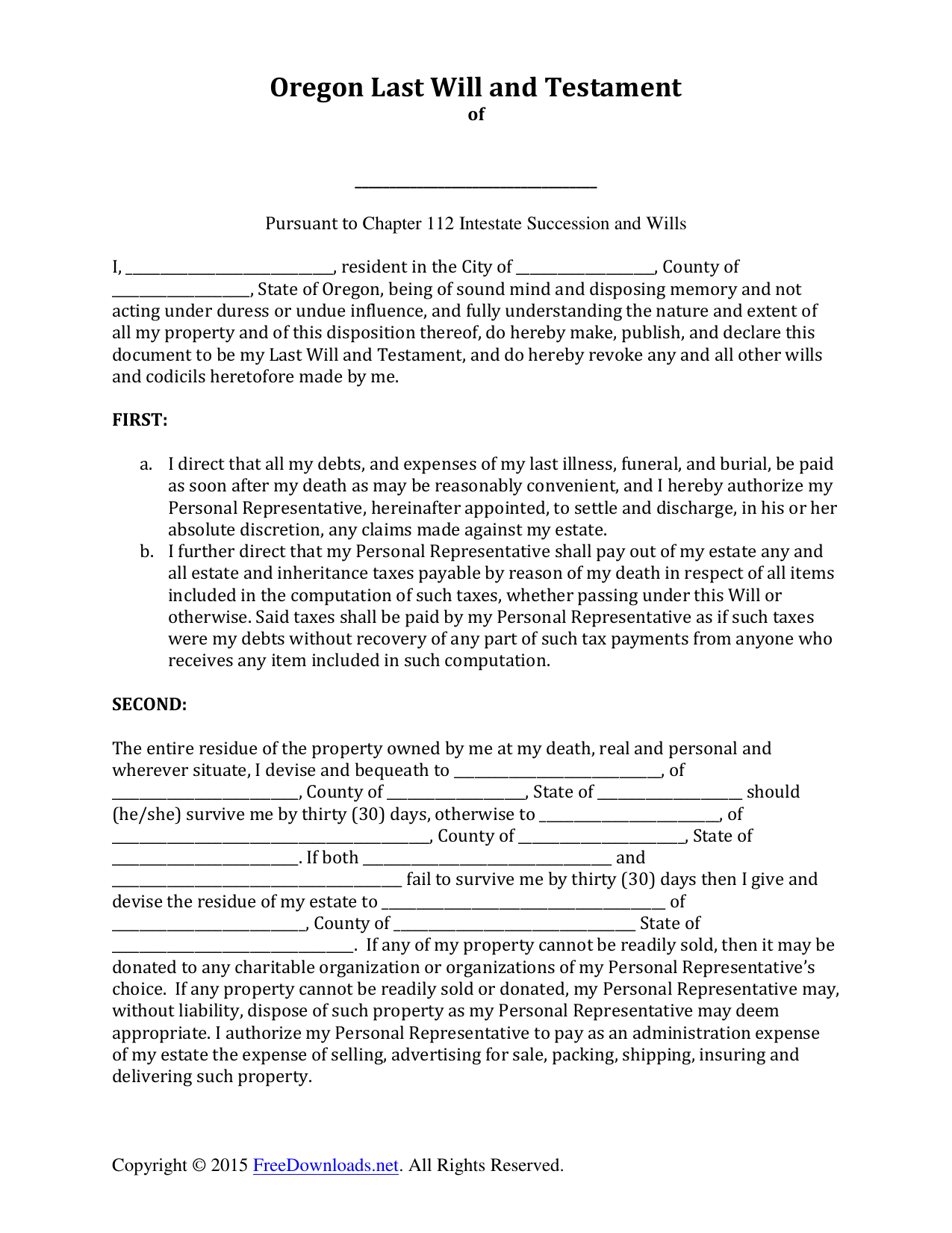

Free living trust forms oregon. A living trust is a legal form devised and drafted to transfer a person s assets to designated beneficiaries when that person dies. An oregon living trust is established by the grantor. Download free living trust forms online fast. A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation.

In addition to bypassing probate the distribution of a trust estate is kept private whereas a will is made public. The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime. Living trusts are well known estate planning devices for families. The trustee is chosen by the person creating the trust the grantor and he or she has an obligation to make sure the provisions of the trust are carried out for the benefit of the beneficiaries.

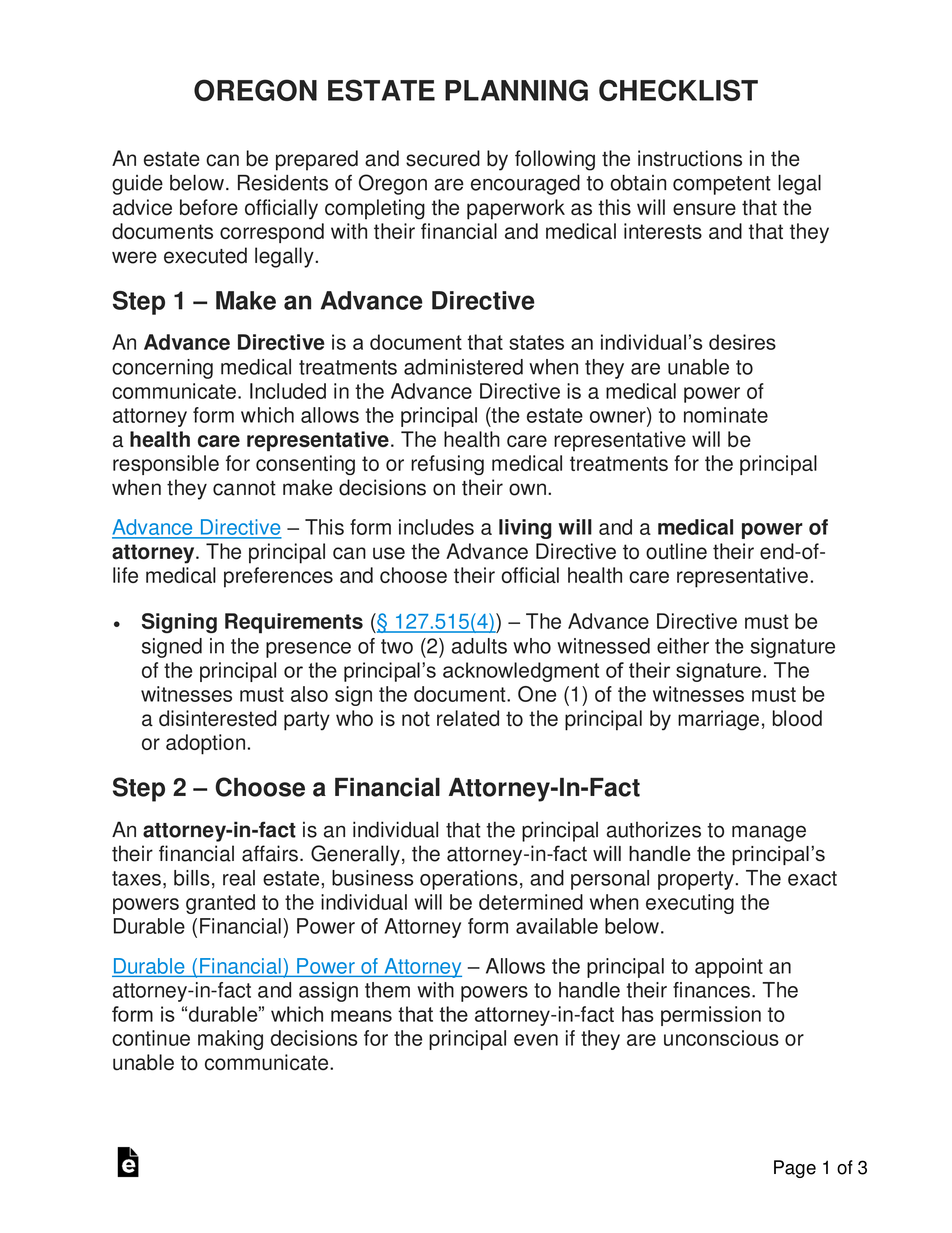

Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time. It is unlikely that a living trust will impact your taxes. Unlike a will a trust does not go through the probate process with the court. It can t hurt though to look into the oregon estate tax and the oregon inheritance tax when you re planning your estate.

Living trusts in oregon. The oregon living trust is an arrangement in which the creator the grantor places their assets into a living trust so that their estate can be distributed without probate. The oregon revocable living trust is used as a primary means of distributing a person s estate in order to avoid the probate process any property not placed in the trust will still be subject to probate when the grantor s estate is distributed. A living trust in oregon allows you to have use and control of your assets while they remain in trust for your beneficiaries.

A living trust is designed especially for the survivors to avoid probate. Living trusts and taxes in oregon. A revocable living trust sometimes known as an inter vivos trust is a popular estate planning option with a variety of benefits. Download a living trust also known as a inter vivos trust that allows an individual the grantor to gift assets and or property during the course of their life to another individual the beneficiary the trustee will be in charge of handling the property even though it belongs to the beneficiary.

Unlike a will this document is created during the course of the grantor s. An irrevocable living trust has the added benefit of also protecting an estate from creditors and law. Remember that estate tax is levied on the estate before it s distributed whereas inheritance tax is paid by heirs after the estate has been distributed.